Blog

News and updates from GammaSwap

GammaSwap LP Performance Analysis

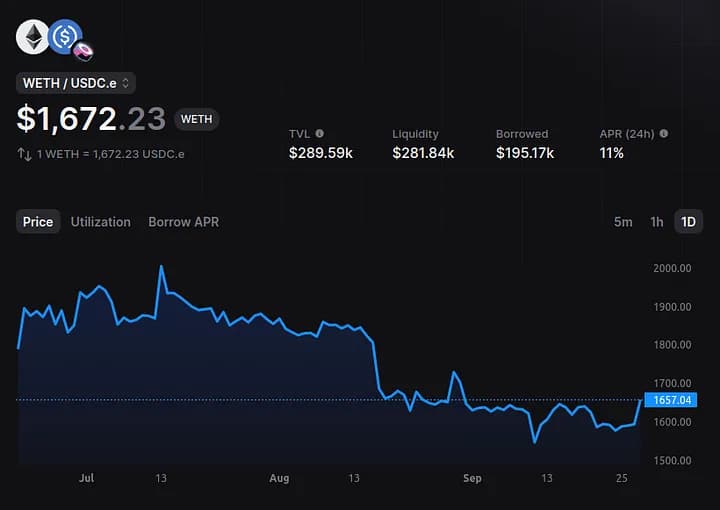

We have performed a study on the following GammaSwap pools against the underlying spot assets: weETH/USDC (Arbitrum), WETH/USDC (Arbitrum) and PENDLE/USDC (Arbitrum).

GS Yield Tokens: Solving the Yield Trilemma

We have yet to see a yield product that is sufficiently decentralized, stable (low risk) and capital efficient until now.

$GS Token Launch

Today, we are excited to finally announce the upcoming launch of the GammaSwap token, $GS. GammaSwap is the first perpetual onchain options protocol and the token will serve to scale up liquidity and decentralize the protocol.

How to Profit from Volatility with GammaSwap

In this article, I will describe how to borrow liquidity from GammaSwap using the web interface and what each of the parameters in the web interface mean.

ImmuneFi Bug Report Analysis & Contract Re-Deployment

This explanation will involve a simplified description of how the protocol works, excluding details about origination fees, trading fees, and interest rates, to aid in the understanding of the security flaw.

esGMX + veCRV Gauges = esGS

The long awaited deep dive into GammaSwap Tokenomics

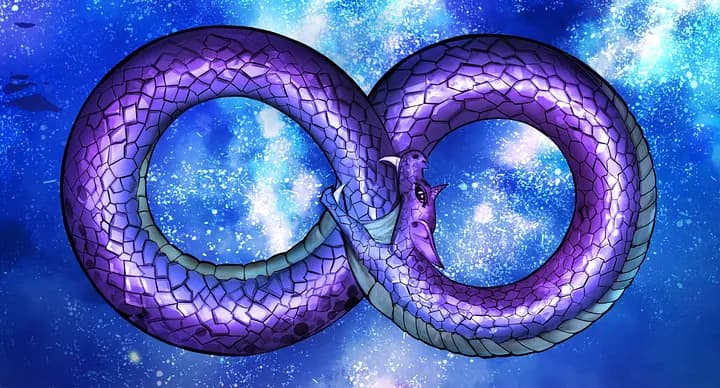

Building Sustainable Protocols: The Emissions Efficiency Ratio (EER) & Crypto Ouroboros

Introducing a new framework to evaluate the sustainability of protocol growth: the Emission Efficiency Ratio (EER).

Monthly Recap — November ‘23

Contract Re-Audit, DeltaSwap, Staking UI, Preparing for TGE🫡

Monthly Recap - October '23

"Soft Launch" with Permissioned Pools, UI Updates, Audits, Re-deployment and More🫡

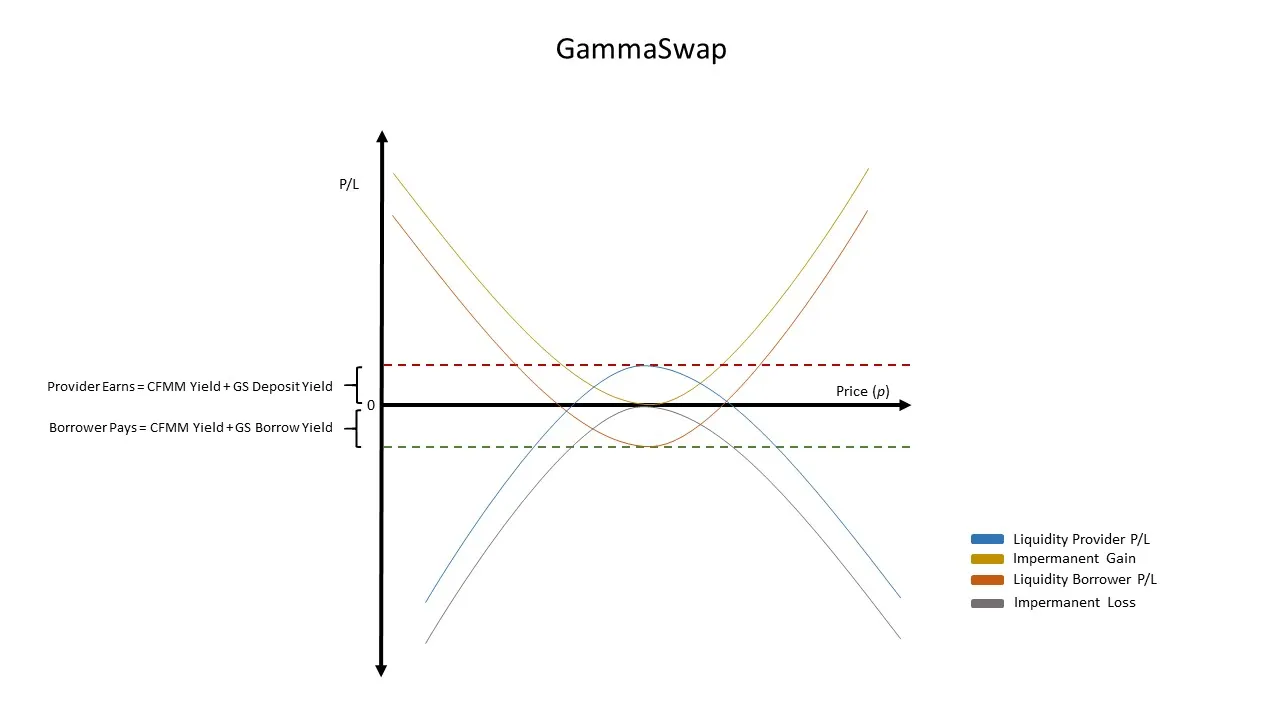

The GammaSwap Contract: P/L, Strike Price, Time to Expiration, Delta, and Fees

In this article I’ll describe the GammaSwap contract, its P/L formula, and other characteristics of the contract that are useful to speculators and hedgers.

GammaSwap is officially live on Arbitrum Mainnet!

Today, after 9 months of Alpha and Beta testing and years of research on Constant Function Market Makers (CFMMs), we’re excited to announce that GammaSwap is live!

Testnet Trading Competition

GammaSwap and Rysk Finance are hosting a trading competition with 50k+ in cash prizes.

GammaSwap Closes $1.7M Seed Round

GammaSwap closes $1.7M seed round to revolutionize DeFi & impermanent gains.

Liquidity Provision at Any Strike Price Under Risk Neutral Pricing

Implications on CFMM Design.

GammaSwap Protocol

GammaSwap protocol is an oracle free decentralized platform for volatility trading and commission free token trading.

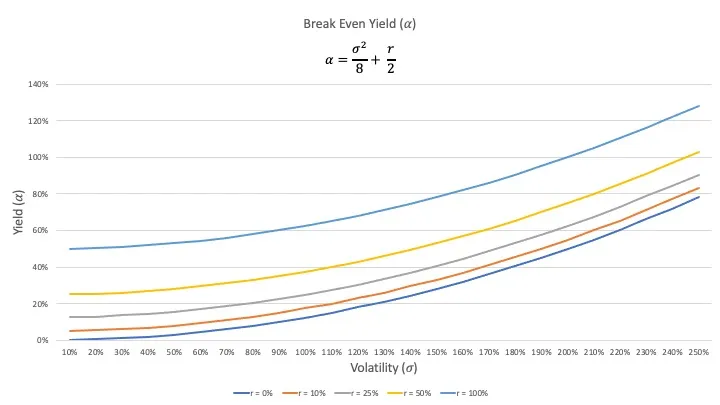

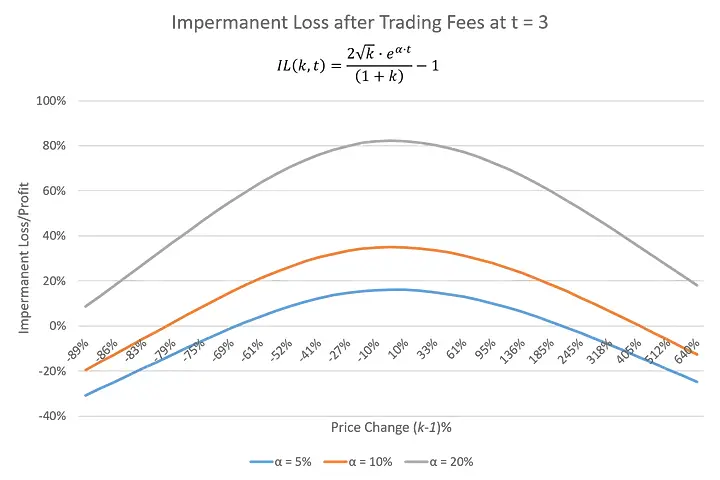

Uniswap Liquidity Provision: Is the Yield Worth the Risk?

Uniswap Liquidity Provision: Is the Yield Worth the Risk?

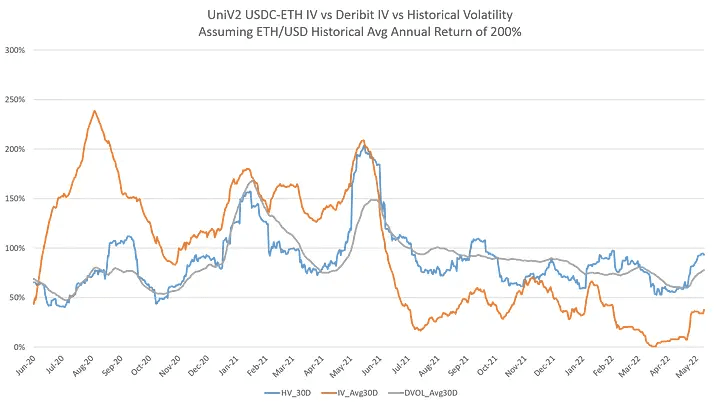

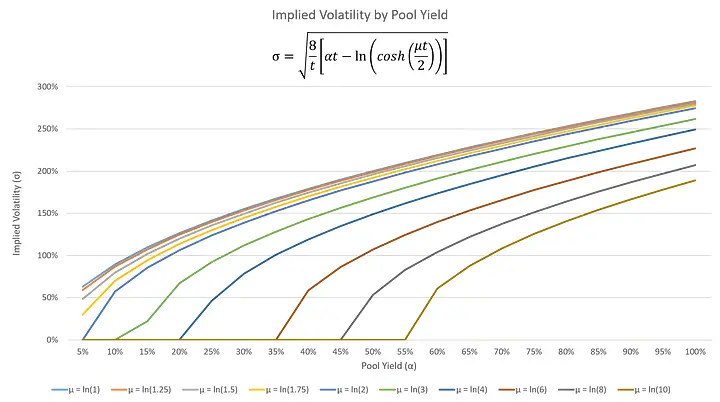

Calculating Implied Volatility from Uniswap V2 & V3

Calculating Implied Volatility from Uniswap V2 & V3

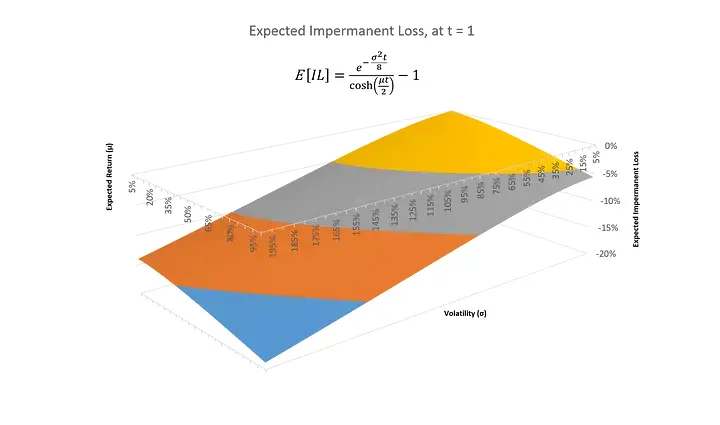

Expected Impermanent Loss in Uniswap V2 & V3

This article explains how to calculate expected impermanent loss in Uniswap V2 & V3.

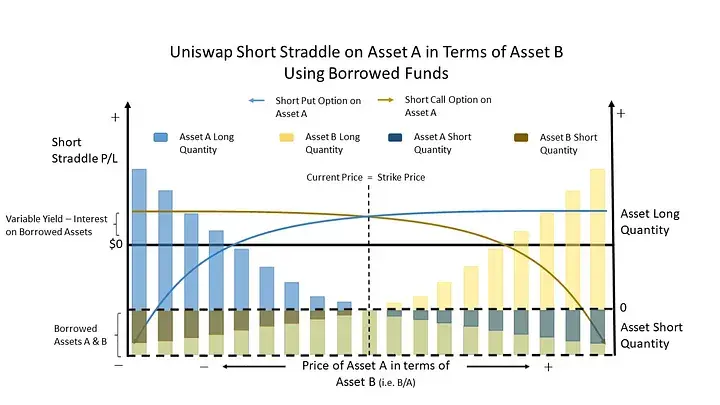

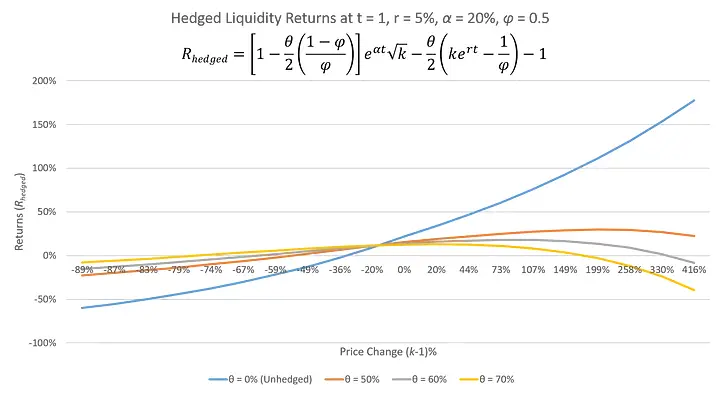

Optimizing Liquidity Provision: Hedging Market Risk in Uniswap V2

This article explains a way to hedge market risk while LPing and prove how hedging leads to better risk adjusted returns that can be magnified through leverage.

Total Returns and Impermanent Loss in Uniswap V2

Total returns and impermanent loss in Uniswap V2 explained.

Uniswap V2: A Constant Function Market Maker

The mechanics of Uniswap V2, a constant function market marker, explained.